In Singapore's dynamic business landscape, small and medium-sized enterprises (SMEs) often require access to equipment to support their growth and success. Equipment financing presents a viable solution, enabling SMEs to acquire essential machinery, technology, or vehicles without a substantial upfront investment. In this article, we will delve into the process and requirements of equipment financing for Singaporean SMEs, tailored to the local context. We will also introduce Banco Equippaid+ as a reliable financing partner, offering valuable resources for SMEs.

Understanding Equipment Financing:

Equipment financing is a specialized form of funding that allows businesses to acquire equipment by spreading the cost over a defined period. Here's an overview of the process and requirements for SMEs in Singapore:

Process of Equipment Financing:

a. Identify Equipment Needs: Assess your specific equipment requirements and determine the type, quantity, and expected lifespan of the equipment you need.

b. Research Financing Options: Explore equipment financing options offered by various financial institutions in Singapore. Consider factors such as interest rates, repayment terms and eligibility criteria.

c. Prepare Documentation: Gather the necessary documentation, including financial statements, business licenses, and legal documentation. These documents will support your loan application and demonstrate your business's financial stability and repayment capacity.

Requirements for Equipment Financing:

To qualify for equipment financing, SMEs generally need to meet the following requirements:

2.1 Business Stability: Most financing institutions prefer businesses with a stable operating history, typically requiring a minimum of two years in operation. Demonstrating consistent revenue and profitability can increase your chances of approval.

2.2 Creditworthiness: Your business's creditworthiness plays a significant role in the financing decision. Maintaining a good credit score, paying bills promptly, and managing existing debts responsibly will enhance your eligibility.

2.3 Financial Documents: Prepare financial documents such as balance sheets, profit and loss statements, cash flow statements, and tax returns. These documents provide insight into your business's financial health and repayment capacity.

2.4 Equipment Details: Provide information about the equipment you wish to finance, including its cost, intended use, and expected lifespan. The financing institution will evaluate the equipment's value and its relevance to your business operations.

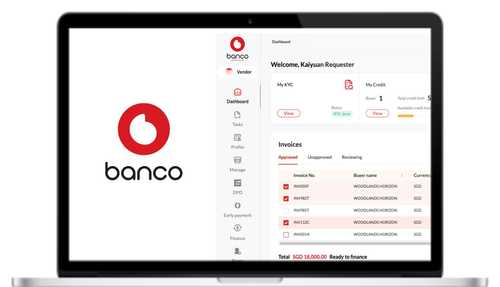

Banco Equippaid+: A Trusted Financing Partner:

Banco Equippaid+ is a leading equipment financing company in Singapore, dedicated to serving SMEs. They offer competitive rates, flexible repayment terms, and a comprehensive range of financing options across various industries. SMEs can benefit from their expertise, personalized service, and commitment to supporting business growth.

To explore equipment financing options and access valuable resources, SME owners can visit Banco Equippaid+'s website (link: https://www.banco.com.sg/equip-paid). Their team of financing specialists can provide tailored guidance and solutions to meet specific business needs.

Conclusion:

Equipment financing is a valuable funding option for Singaporean SMEs seeking to acquire necessary equipment while managing capital and cash flow effectively. By understanding the process and meeting the requirements, SME owners can navigate equipment financing with confidence. Banco Equippaid+ stands as a trusted financing partner, offering valuable resources and customized solutions to support SME growth.