Among the multiple things that the recent pandemic has fuelled, sustainability through conscious consumerism is one of the most significant.

The good news: Global economies and a large number of companies in each of the geographies have earmarked to take action. Most of them announced NetZero or carbon-neutral commitments by pledging to reduce greenhouse gas emissions and investing in climate action.

Closer home, Singapore, in its effort to lead the SEA region in sustainable development and financing, unveiled the Singapore Green Plan 2030 ("Green Plan"), last February.

It is a "living plan" that will evolve with the local society as new technologies and solutions present fresh or improvised options under the Environmental, Social and Governance (ESG) matters of any business.

The fundamentals of ESG:

ESG facilitates top-line growth in the long run, attracts talent, reduces costs, and forges a sense of trust amongst consumers.

● ‘E’ in ESG, is for Environmental. It looks at the impact of resource consumption of any business on the environment like carbon footprint and wastewater discharge, among other environmental impacting activities.

● ‘S’ or Social criteria scrutinizes how a business interacts with communities where it operates. It also looks at the internal policies of the business, as related to workforce diversity and inclusion, among others.

● ‘G’ or Governance relates to internal practices and policies that lead to adequate decision-making and legal compliance.

Singapore Context of ESG

Spearheaded by five ministries, in Singapore, the goal of a sustainable business strategy is to make a positive impact on at least one of the five pillars of the Green Plan namely:

- City in Nature

- Sustainable Living

- Energy Reset

- Green Economy, and

- Resilient Future

To achieve these pillars, the government has introduced a comprehensive array of initiatives and support measures in the research and development, energy, green finance, sustainable tourism, and land transport sectors.

Taking a cue from the world leader, the business world including the VC circles and investors in recent times uses ESG metrics to analyze an organization’s ethical impact and sustainability practices.

ESG: Benefits abound

The intersection between environmental and social progress ultimately resulting in financial gain is called the shared value opportunity. In simpler terms, “doing good” can have a direct influence on a business’s ability to “do well.”

According to NTUC’s 2022 Sustainability report, in Singapore: more than 9 in 10 business leaders affirm the importance of sustainability and its integration into their organization’s overall business strategy.

Although there is much awareness and seeming support from governing bodies, the path to achieving NetZero is murky and muddled with considerable challenges.

ESG Challenges

It is now well established that the pressure to improve ESG performance is not a fad. And while designing the strategy is demanding because of the multitude of factors to consider, operationalizing ESG across the board and the larger organization is even harder.

The most complex challenges when it comes to achieving ESG goals are:

● System (organizational infrastructure) issues beyond the immediate control or requiring major transformational undertaking.

● Balancing long-term value creation against the pressure of short-term financial requirements, especially true in the startup ecosystem.

● ESG covers a wide range of topics and hence making it tangible and meaningful organization-wide, such that all employees are accepting and working towards one common goal calls for meticulous engagement.

● The need to build a strong partner network comprising of the right suppliers, nongovernmental bodies (e.g - NGOs), and maybe even competitors along the entire value chain, equally committed to the cause

● On the softer end, the need to implement operational changes throughout the organization

● Increased overarching business-wide cross-functional collaboration and the sophistication of a plethora of change initiatives

When it comes to something as complex and nascent as ESG, missteps are going to happen. One can sit back and watch other businesses make them, or can take the risk as a leader and carve out the future they want to take, helping others along the way.

Being people-driven, the participants and champions, therefore, play a critical part.

The Stakeholders

Every organization has a myriad of stakeholders that impact the way it operates. Putting an ESG program on the floor requires high-level executive buy-in, resources, strategy, external advice, and a plan for reporting results.

It is important to optimize people engagement throughout the process to identify high-priority and high-impact areas to focus on. The stakeholders (both future and present) include:

● Regulators and industry groups

● Governments and nongoverning bodies

● People

● Communities

● Customers/clients

● Suppliers

● Financers

It is important to engage with the vision that more than a competitive advantage ESG is an opportunity to lift the organization, related industry, and the rest of the world to accomplish things that impact everyone for the better.

Thus organizations operating toward enhancing their sustainability and transparency efforts should prioritize engagement with said stakeholders who have the most significant influence and interest in their ESG processes.

They are one, who will help drive actions toward more sustainable operations. Without stakeholder engagement, managing risk around access to market, capital, and talent is unattainable.

Having said, one of the fundamental challenges faced by business leaders is to align and integrate sustainability strategies to that of the overall organization during goal setting and implementation stages of said initiatives.

This had led more than a third of business leaders (36%) to profess that their organization needs external help in this area to further pursue sustainability objectives.

Join banco to achieve your sustainability goals.

A "whole-of-nation movement", to advance Singapore's national agenda on sustainable development, the Green Plan demonstrates Singapore's willingness to take firm actions to build a sustainable future and address climate change.

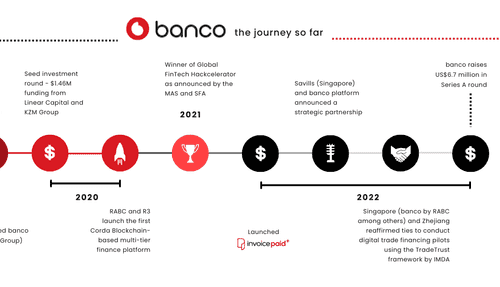

At banco (RABC group) to start with the two industries we believe have the most potential to leverage technology, and inch closer to carbon-negative goals are:

1. The property management sector, where we partner with Savills - Singapore's largest private MCST Managing Agent and

Transforming payments through digital processes, the banco platform (i.e. online only financing), simplifies the issuance and payments between Strata Management stakeholders creating greater transparency, compliance, and governance for all.

2. Trade and supply chain management, where we work in tandem with IMDA on TradeTrust

A consortium of companies from Zhejiang and Singapore (banco by RootAnt among other) were formed to conduct digital trade financing pilots using the TradeTrust framework by the Infocomm Media Development Authority (IMDA), to enable the digitalization and authentication of important trade documents, such as the bill of lading, in the cross-border trade financing process.

Next at banco

A sustainable future is an inevitable one, and business leaders across industries need to realize that prioritizing sustainability is good for business, society and the planet as these are all interrelated.

BancoX, our next launch, aims to bridge the gap between business owners and sustainability suppliers by providing a one-stop B2B Marketplace for green equipment and carbon credits.

Designed to power the small and medium enterprises to make a real impact for a better future, bancoX allows businesses to obtain industry best practices, source certified green equipment, and explore finance options to support the sustainability journey.

BancoX aims to move the notion of sustainability from awareness to action as business responsibility and accountability create a resilient and sustainable future for the community in the long term.

We are here to enable and champion your business towards NetZero goals. Let's create a better world for future generations together, after all, there is no planet B.