Going green with digital financing solutions powered by TradeTrust

In line with Singapore’s aspirational “Green Plan 2030”, there is a need for every aspect of the trade and supply chain management to work on reducing its carbon footprint. In creating electronic Bills of Lading (eBLs) solutions powered by TradeTrust, all players, including governments, fintech, carriers, traders, and banks will create a “trade document and trade finance/supply chain finance” ecosystem which powers regional businesses’ access to digital solutions, which assists in reducing paper carbon footprint and improve its’ efficiency.

There are various benefits associated with digital solutions powered by TradeTrust, such as legal certainty for electronic transferable documents, increased efficiency, lowering costs & reducing the risk of fraud. TradeTrust provides an easy way to digitalise paper-based trade documents into digitally-signed assets that are compliant to MLETR4 requirements. In addition, TradeTrust-enabled documents are in harmony with the current paper-based processes as it is able to seamlessly transit from paper to digital and vice versa as it passes different parties along the value chain, catering to different degrees of digital readiness.

eBL solutions powered by TradeTrust could potentially improve and enable paperless Letter of Credit workflows, which allow parties associated with a trade to issue, receive and transfer the title of eBLs, bringing the benefits across to the entire ecosystem.

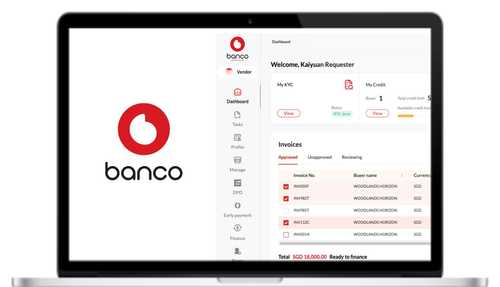

Pilots powered by TradeTrust and banco platform between Singapore and China

Singapore-Zhejiang Economic Trade Council (SZETC) Pilot

The pilot between Singapore and Zhejiang, was mentioned in Enterprise Singapore’s press release about the 16th Singapore-Zhejiang Economic and Trade Council (SZETC) meeting, “A consortium of companies from Zhejiang and Singapore (including banco platform) were formed to conduct digital trade financing pilots using the TradeTrust framework by IMDA, to enable the digitalisation and authentication of important trade documents, such as the bill of lading, in the cross-border trade financing process”6 .

Chongqing Connectivity Initiative (CCI) New International Land-Sea Trade Corridor (ILSTC)

Mr Ravi Menon, Managing Director, Monetary Authority of Singapore in his Keynote Speech at the SingaporeChina (Chongqing) Financial Summit on 23 November 2021 mentioned, “RootAnt, a Singapore FinTech firm has signed an agreement with the Bank of China (BOC) to serve as the trade financing platform on the Singapore side, enabling traders, logistics companies, and BOC’s branches to exchange electronic trade documents under the CCIILSTC for trade financing purposes”5 .

Next move

Banco platform continues to support TradeTrust and its initiatives via collaborations and innovation in green financing related new solutions as part of its future roadmap.

Article by Lincoln Yin, CEO of banco platform, RABC Group

View the full article here