RootAnt raises USD$ 1.46 million to expand across Singapore, the rest of Southeast Asia, and Japan as the first Banking as a Service Fintech that provides embedded multi-tier financing solution in the region

RootAnt aims to continue innovating its Banking-as-a-Service through extensive research and development (R&D) processes to benefit businesses within supply chain ecosystems, especially in the sphere of small to medium enterprises (SMEs) with embedded financing solutions

Singapore, 1 October 2020 — RootAnt, the first Banking as a Service Fintech that provides embedded multi-tier financing solution in Singapore, today announces the completion of its seed investment round led by Linear Capital and with co-investor KZM & Company Group. The completion of this round brings the total of RootAnt’s seed capital sum to USD $1.46 million.

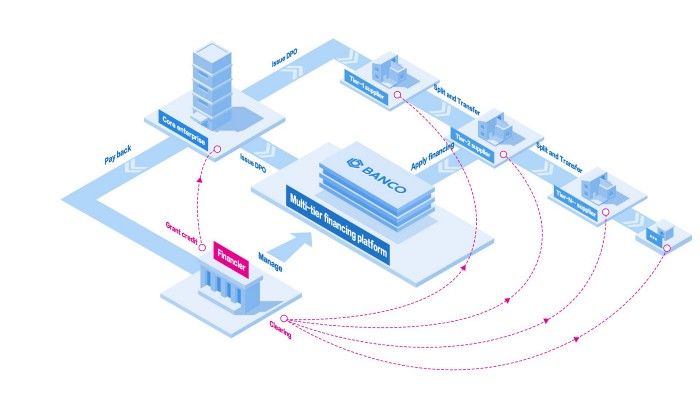

RootAnt is the technology enabler for Banking as a Service (BaaS), that connects enterprises and financial institutions with new digital financial products for easier, cheaper and faster financing services. This empowers banks and non-bank financial institutions to integrate more digital banking capabilities, including embedded financing to create richer end-to-end journeys for their customers on their respective platforms. This effort is also in line with the Singapore government’s aim for digital-only banks. As COVID-19 has caused many SMEs to face harsher challenges in making payments while ensuring healthy liquidity, the push toward more innovative and relevant digital banking solutions has become a priority.

Beyond that, RootAnt’s multi-tier financing solution involves the use of Digital Payment Obligation (DPO) as a payment instrument. This enables SMEs to obtain timely financing and maintain a healthy cash flow through lower financing costs, easier access and faster processing. At the same time, anchor corporates using DPOs will have access to balance sheet optimization and better financing, allowing them to create more sustainable value-chains.

Commenting on the seed funding, CEO and Founder of RootAnt, Mr. Lincoln Yin said,“ We aim to address the financial challenges faced by businesses caused by COVID-19, and also to create avenues for business sustainability, growth and continuity. The current economic climate requires innovation and customer-focused digital solutions that truly make a difference for a more sustainable economy. Through our digital and open banking technological capabilities for transaction banking, we aim to become a key player in this industry to continue supporting businesses with their financing demands as they recover from the impact of COVID-19.”

RootAnt will be utilizing this capital for expansion in Singapore, the rest of Southeast Asia and Japan, with an aim to provide both anchor corporates and SMEs with new and enhanced solutions on its platform. This includes research and development (R&D) for further development of BANCO Engine (Banking as a Service) and the multi-tier financing platform, to support businesses within supply chain ecosystems.’

Speaking about the investment into RootAnt, Can Zheng, Managing Director of Linear Capital, a leading early stage VC in Asia that focuses on technology-driven startups said, “The general characteristics of the companies we care about are data-based, AI driven and commercially-applicable. The RootAnt team knows technology and finance deeply. As the Banking-as-a-Service sector has been thriving, RootAnt’s product fits the market well. In 2020, given the challenge of COVID-19, the business of RootAnt still grew fast. We believe the team will keep bringing value to existing and potential clients in the Southeast Asian market.”

“We believe in the potential of RootAnt’s business across Asia. Particularly nowadays, there is a nation-wide mega-trend of digital transformation in Japan across various industries. RootAnt can fully contribute to this evolutionary movement in Japan and KZM can support its localization,” said Kazuma Yamauchi, Founder and CEO of KZM & Company Group.

Additionally, other financial solutions that RootAnt are planning to launch this year will cover verticals such as SME Finance, Green Finance, Islamic Finance, and BANCO Chain (a trusted blockchain network for supply chain finance), among others.

For more information on RootAnt, please proceed here.

- END -

For media enquiries, please contact:

Charlotte Ma

Account Executive, Elliot & Co.

HP: (65) 9725 3141

Email: charlotte@elliotcommunications.com

About RootAnt

RootAnt is a technology enabler of Banking as a Service, specializing in Embedded Financing for enterprises, connecting enterprises and financial institutions with new digital financial products for easier, cheaper and faster financing services in various contexts. RootAnt is headquartered in Singapore and branch offices in China and Japan. For more information on RootAnt, please visit www.rootant.com.

About Linear Capital

Established in 2014 by Facebook’s second Chinese engineer and first R&D manager Harry Wang, Linear Capital is an early stage venture from Shanghai, focusing on technology-driven startups. The firm’s main investment focus includes projects in the Data Application, Data Infrastructure and Frontier Technology domains. To date, the valuation of all portfolios of Linear Capital has reached around 15 billion US dollars. The fund is striving to build the best Data Intelligence Technology Fund, and gradually become the best Frontier Technology Application Fund. With RootAnt being the member of its portfolio, other companies include Horizon Robotics, Rokid, MagicShield, Kujiale, Seeta, Sensors Data, and Agile Robot, among others. For more information on Linear Capital, please visit www.linear.vc.

About KZM & Company Group (“KZM”)

KZM is an international business creator with solid expertise in finance, IP management, and global expansion, with its presence in the US, Hong Kong, and Japan. KZM provides holistic support to its clients from establishing a company and getting initial investments to growing the operation and leading the exit transaction. KZM has previously co-founded KonMari Media Inc., a US-headquartered global business based on contents created by Marie Kondo. KZM currently supports various venture businesses across the US, Japan, and Asia.