- Series A round was led by SBI Group alongside SMBC

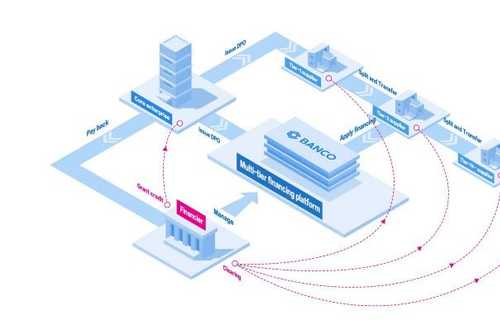

- Through its digital platform - banco, the firm delivers sector-focused and green financing solutions for MSMEs in Southeast Asia

Singapore, 30 August 2022 – Singapore-headquartered, Financial Technology (FinTech) company, banco (RABC Group) today announced the successful raise of US$6.7M in Series A funding led by Japan-based leading financial group SBI Group, alongside investors Sumitomo Mitsui Banking Corporation (SMBC), R3, Savills, KZM & Company, and others.

With this fundraise, banco will look towards recruiting talents with technology and business development expertise, as well as, market expansion within the Southeast Asia region.

Founded in 2018, banco (RABC Group) is headquartered in Singapore with subsidiaries in China and Japan. The banco platform leverages the digital capabilities of the RABC group’s expertise in Micro, Small and Medium Enterprises (MSME) lending and close industry partnerships, to develop sector-focused and sustainable financial solutions for MSMEs.

“We are excited to lead banco’s Series-A fundraising together with our strategic partners, SMBC and R3. There would be collaborations among SBI, SMBC, R3, and banco, to offer more inclusive financing solutions and achieve ESG targets for SMEs in Asia. We believe that banco will grow to be the leader in its sector.” says Yoshitaka Kitao, CEO, SBI Holdings.

The SBI Group, founded in 1999, has achieved significant growth by offering varieties of financial services beneficial to consumers by riding the two major trends of “financial deregulation” and the “Internet Revolution.”

In Japan, the SBI Group has fully utilised the Internet as its main channel and accomplished creating a financial ecosystem in the Financial Services Business centering on securities, banking and insurance, to become a unique comprehensive financial group that could not be seen anywhere else in the world. The SBI Group has also concentrated in both domestic and overseas investments of the next generation growing industries while investing aggressively in developing countries in Asia, as well as taking part in incubating new startup companies.

“With this new round of fundraising, we are looking to the future where the group can use our existing fintech capabilities to build better sustainable financial infrastructure for MSMEs in Asia, and to expand regionally. We are excited, yet humbled by the trust and support from our clients, partners, and investors as we develop new capabilities and unlock new opportunities in this financial transformation era.” says Lincoln Yin, Co-founder & CEO, banco (RABC Group).

Moving forward, the group will focus on offering green financing solutions for MSMEs and corporates in optimising cash flow and improving sustainability in their entire value chain.

banco has also recently partnered with leading real estate advisor, Savills (Singapore) to digitise financing solutions and enhance sustainability practices in the property industry1. With more industry partnerships in the pipeline, banco aims to reach out to more than 1000 MSMEs in 2022.

“In Southeast Asia, MSMEs contribute more than 50% of ASEAN countries’ GDP, but still face challenges with securing financing to cover the needs of their business. Moreover, as ASEAN is adapting to climate change, it is increasingly important to ensure that MSMEs are included and incentivised to become greener and sustainable is critical, as the region pivots towards a more sustainable path of development. Technology and new data-driven financial products will play an important role in improving the access to sustainable finance for MSMEs”, added Lincoln.

About banco

Founded in 2018, Fintech banco (part of RABC Group), is a fintech company headquartered in Singapore with subsidiaries in China and Japan. Together with its subsidiaries, the group is on the mission of building better financing solutions in Asia. The banco platform solves current industry challenges by providing better, faster, and cheaper financing solutions. The company was the top winner of the Monetary Authority of Singapore’s Global FinTech Hackcelerator in 2021.

For further enquiries, please contact: Lim Kai Yuan, Marketing lead (media@banco.com.sg)

Also published on:

- Fintech Global - https://member.fintech.global/2022/08/30/singaporean-fintech-banco-rakes-in-6-7m-series-a/

- Crowdfund Insider - https://www.crowdfundinsider.com/2022/08/195360-banco-raises-6-7-million-series-a/

- Fintech & Finance News - https://ffnews.com/newsarticle/singapore-headquartered-fintech-banco-raises-us6-7-million-in-series-a-round/

- Finextra - https://www.finextra.com/pressarticle/93855/singapore-headquartered-fintech-banco-raises-us67-million-in-series-a-round

- Yahoo! Berita - https://id.berita.yahoo.com/news/singapore-headquartered-fintech-banco-raises-033600685.html

- Yahoo! Finance - https://finance.yahoo.com/news/singapore-headquartered-fintech-banco-raises-033600685.html

- Finanzen - https://www.finanzen.net/nachricht/aktien/singapore-headquartered-fintech-banco-raises-us-6-7-million-in-series-a-round-11672910

- User Wall - https://www.userwalls.news/n/singapore-headquartered-fintech-banco-raises-million-series-round-3750731/

- Crypto Productivity - https://www.cryptoproductivity.org/singapore-headquartered-fintech-banco-raises-6-7-million-in-series-a-round-3/

- MarketNode - https://technode.global/2022/08/30/singapore-fintech-firm-banco-raises-6-7m-series-a-round-led-by-sbi-group/